Bitcoin and the Fourth Turning: Could This Wild Theory Predict a $444,000 Surge?

Unveiling Bitcoin’s $444,000 Potential: How the Fourth Turning Could Reshape Crypto and Society

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always consult with a professional financial advisor before making any investment decisions.

What if everything you’ve trusted—governments, banks, even the dollar in your wallet—crumbled overnight? Sounds like a dystopian movie plot, right? Yet, some sharp minds on Wall Street and crypto circles are buzzing about a concept called the "Fourth Turning," tying it to Bitcoin’s meteoric potential. Picture this: a guy named Josh Mann nails Bitcoin’s price at $84,000 on March 14th—spot on, to the dollar—and now he’s calling for $444,000 by the end of this bull run. Crazy? Maybe. But when you dig into the theory behind it, it’s hard not to sit up and listen.

This isn’t just about crypto hype. It’s about a seismic shift in how society operates, and Bitcoin might be the lifeboat in the storm. Let’s break it down like you’re chatting with a friend over coffee—simple, real, and with a few eyebrow-raising twists.

What’s This "Fourth Turning" Thing Anyway?

Ever heard of a cycle that says society flips upside down every 80-100 years? That’s the Fourth Turning, a theory from historians Neil Howe and William Strauss. They argue history moves in four-stage loops—growth, maturation, unraveling, and then chaos—before resetting. The last "turning" gave us the Great Depression and World War II. Now, folks like Josh Mann reckon we’re smack in the middle of another one, starting around 2008 with the financial crisis and heading toward a wild climax soon.

Why’s this matter for Bitcoin? Because chaos breeds distrust. When banks fail, governments bicker, and currencies wobble, people look for something solid. Mann’s take? Bitcoin’s that rock. He’s not alone—Wall Street vet Howard Lutnick’s even hinting at the U.S. government buying Bitcoin big-time. “The further we go, the more people realize the world of hurt we’re in with currency debasement,” Mann’s been quoted saying on X. Spooky, but it tracks.

A Fictional Scenario to Chew On

Picture Sarah, a 30-something nurse in Chicago. She’s got $10,000 in savings, but inflation’s eating it alive—groceries up 20%, rent spiking. The news is all trade wars and sanctions. One day, her bank freezes withdrawals due to "system issues." Panicked, she moves half her cash to Bitcoin at $85,000. Six months later, trust in the dollar tanks, and Bitcoin’s at $200,000. Sarah’s not rich, but she’s breathing easier. Could this be the Fourth Turning in action?

Why Bitcoin Could Thrive in the Chaos

Think about it: if traditional systems erode, what’s left? Gold’s heavy, banks are shaky, and cash feels like Monopoly money when inflation’s rampant. Bitcoin’s got quirks—volatility’s a beast—but it’s got perks too. Here’s why it might shine:

Trustless and Decentralized: No one controls it. No shady CEO or politician can mess with your stash.

Fast and Cheap: Move millions across borders for pennies in minutes. Try that with a gold bar.

Hard Cap: Only 21 million coins ever. Compare that to governments printing cash like it’s confetti.

Geopolitical mess—like strife in South Africa or Europe—could push folks to Bitcoin as a safe haven. Mann predicts capital flight will skyrocket, and he’s got a point. Inflation’s hitting double digits in places like Argentina. People there are already hoarding crypto.

“Bitcoin is the ultimate hedge against a world gone mad,” says Cathie Wood of ARK Invest, a big believer in its long-term rise. She’s not wrong—stability’s looking dicey out there.

The Spicy What-If: Government Buying Bitcoin?

Here’s where it gets juicy. What if the U.S. government, led by folks like Howard Lutnick, starts stockpiling Bitcoin? Lutnick’s floated cutting $2 trillion from the budget, selling gold, and pumping that cash into crypto. He’s reportedly said, “We’ll force Bitcoin up 10x and set the stage for the future.” If true, that’s a game-changer. A government-backed Bitcoin boom could shove prices past Mann’s $444,000 faster than you can say "bull run."

But there’s a flip side. Some reckon it’d kill Bitcoin’s rebel spirit—turning it into just another tool for the suits. Controversy?

Real-World Snapshots

Take MicroStrategy—its stock’s tied to Bitcoin, and Lutnick owns a chunk. They’ve got $200 million in BTC now, potentially billions later. Or look at ETFs: BlackRock’s IBIT has been gobbling up Bitcoin daily. The data’s there—big players are betting hard.

How High Could It Really Go?

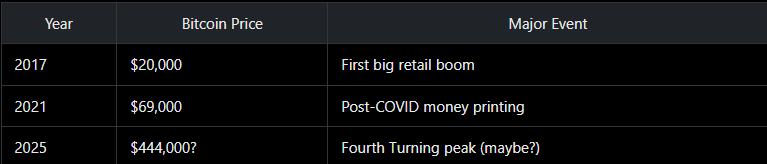

Mann’s $444,000 call isn’t random—it’s tied to this Fourth Turning chaos peaking. He’s banking on a "spring effect"—the longer Bitcoin holds a base (like $84,000), the higher it could bounce. Look at this table:

Skeptical? Fair. Predictions are dicey—Bitcoin’s dropped 20% in a week before. But if trust in fiat keeps eroding, and tech adoption grows, $444,000 doesn’t sound that nuts.

Anecdote Time

Meet Tom, a fictional trader buddy. Back in 2020, he bought Bitcoin at $10,000, sold at $60,000, and kicked himself when it hit $85,000 this year. Now he’s eyeing Mann’s call, wondering if he should jump back in. “If the world’s falling apart, I’d rather have BTC than a savings account,” he grumbles over beers. Hard to argue with that logic.

The Risks Nobody Talks About

Let’s not sugarcoat it—Bitcoin’s no sure thing. Stablecoins can crash (remember Terra?), regulations could tighten, and if the grid goes down in some apocalyptic Fourth Turning twist, good luck accessing your wallet. Plus, $444,000 assumes a lot—mass adoption, government moves, no major hacks. It’s a bold bet, not a bedtime story.

Still, the upside’s tantalizing. Even if it hits half that—say, $222,000—it’s a win for early birds. Peek at his X thread where Mann defends his stance—dude’s got conviction.

What’s your take?

Wrapping Up the Crazy Ride

The Fourth Turning’s a mind-bender—society in flux, trust evaporating, and Bitcoin possibly riding the wave to insane heights. Mann’s nailed predictions before; Lutnick’s dropping hints that’d make any crypto fan’s ears perk up. Is $444,000 pie-in-the-sky or a glimpse of what’s coming? Time’ll tell, but the setup’s got people talking—and for good reason.

“Chaos is the mother of opportunity,” Warren Buffett once said (kinda—he’s more about calm markets, but it fits). If this theory holds water, Bitcoin might just be the opportunity of a lifetime—or a wild ride to watch from the sidelines.

Disclaimer: This article is for informational purposes only and should not be considered as investment advice, financial planning, or any other type of professional guidance. The information provided is based on publicly available data and may not reflect the author's or publisher's personal views or opinions. No effort has been made to ensure that the information is accurate, complete or up-to-date.

The author and publisher are not responsible for any losses or damages that may arise from the use of the information contained in this article. If you are considering any type of investment, financial transaction, or other decision that may have financial implications, please consult with a qualified professional financial advisor or other qualified expert before making any decisions